As So

R.A.F. Walker

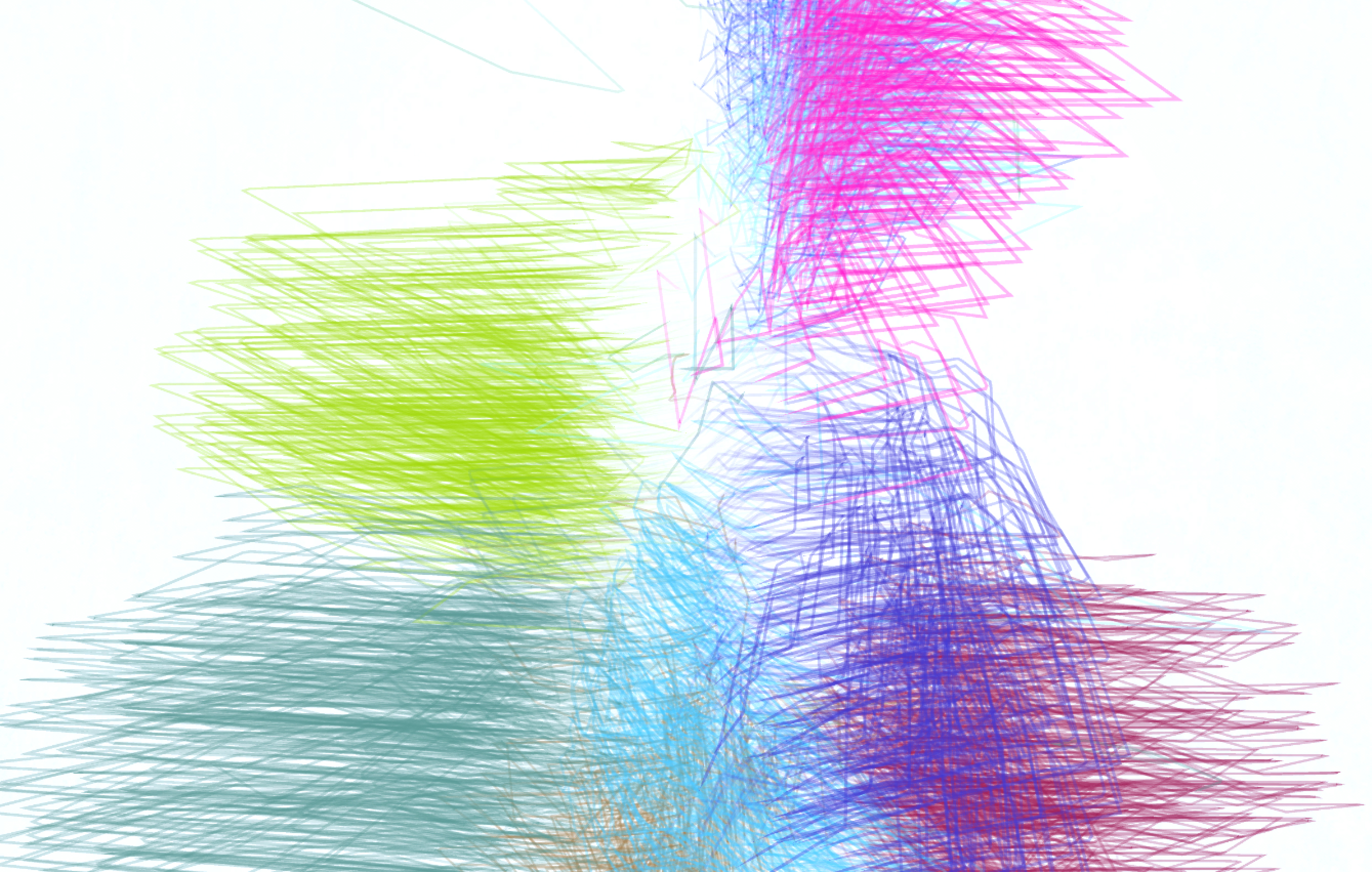

Credit: R.A.F. Walker, 2018

Credit: R.A.F. Walker, 2018

An infant, up to its elbows in primary coloured poster paint. Wild gestures smeared on broad sheets. The birth of meaning through mark making begins afresh in every intelligent entity.

An altcoin trader uses an internet squawkbox to ruminate on the effect AlphaGo would have on crypto markets if unleashed. Altcoins - alternative blockchain projects to Bitcoin - attempt to implant Bitcoin's consensus-through-adversarial-market model into different social and industrial processes, from supply chains to collectable, mateable, digital cats. There are thousands of altcoins - some are currencies, some are utility tokens, some are security tokens - all are tradable, all the time, everywhere.

Altcoins further the tendency to hollow out our lives by intermediating them with techno-scientific processes. Marrying these with capital markets is a foundation of neoliberalism, so thus the utopian ideals of altcoins become a new domain in the dynamics of capital.

“Spend what you like. Exchange with whom you like. Earn in the way you like.”

Do these collective transactions become real micropolitical revolutions, or just a multiplicity of markets for algorithmic exploitation and monopolisation? While projected as social emancipation - the opportunity to form glocalised catalaxies with programmatically enforced ethics - subjugation has long worn the mask of freedom.

Current algorithmic trading can be characterised by two poles: the meticulous macro models of Renaissance Technologies and the nanosecond statistical arbitrage of High Frequency Trading. While details of their processes are hidden, publicly available automated trend detection and support/resistance algorithms trace the same underlying form. By pointing them at nascent crypto markets we see a picture of raw human speculation, all greed and fear and utopia.

These images contain wild gestural strokes, as full of unconscious emotion as any abstract painting. Compared with images of the same visualisation algorithms applied to traditional markets (stocks, commodities, etc), themselves already intermediated by algorithmic high finance, they show the energetic forms of an aggregate unconscious unencumbered by modulating extractive forces.

This is what makes them attractive to predators.

Go, which roughly translates as 'the encircling game', is an ancient Chinese board game in which a player must attempt to defeat their opponent on a board that is static yet in constant flux. Boundaries, safe spaces and territories are always changing. In 1972, Gilles Deleuze and Felix Guattari conceptualised Go as analogous to the process of market expansion they call 'deterritorialization'.

AlphaGo, an AI developed by DeepMind (now owned by Google) to play Go, became the Go world champion by defeating Lee Sedol in 2016. Yet it is generalised enough to turn its hand to other games. Knowing nothing of chess, it learnt and mastered the game in four hours. If Go is not the goal of AlphaGo, then, maybe Alpha is. (In finance, ‘alpha’ denotes return on investment as measured against a benchmark.)

Like art students sketching fruit bowls, AI training has its formal primitives. MNIST is the apple in this bowl. MNIST contains 55,000 handwritten samples of numbers 0 to 9. Neural network models are built to recognise the similarity between samples of the same number, and thus the difference between the numbers, and then predict which number a test image contains. This training process is the first step of discernment, upon which machine intelligences are built. The implications are that the intelligence behind visual perception can be synthesised with 28x28 grids of grayscale pixels, and that the primordial forms are numbers.

This training process can be visualised. Such visualisation becomes an abstract clawing for meaning, as the AI groups sample images based on statistical commonalities. This process, and others like it, become the logical primitives in the minds of the future. This structure will be as lowly as electron exchange or mitosis, relative to the complex constructs they afford, which will take them far beyond finding faces and driving cars.

And what of our altcoin trader’s rumination? The market is an endless Go game that is always one step ahead of rational comprehension, a fractal flux of adversarial intelligent becoming. If two AlphaGo-grade AIs entered a financial market, then the feedback loop would be so rapidly auto-complexifying as to leave existing models and human operators in the dust. It is in this market-driven model of value that a strain of intelligence is born, the fractal reflection of design and outcome.

As above, so below.

This reduction of a hermeneutic aphorism to formal logic becomes a linguistic distillation of the process that bares this intelligence. The quote comes from ‘The Emerald Tablet’ which was described by Jungian psychiatrist Dr. Edward Edinger as “a recipe for the second creation of the world.” Yet in this paraphrasing it omits the concluding line, a line which reveals the truth of what is lost - “to accomplish the miracles of the One Thing”.